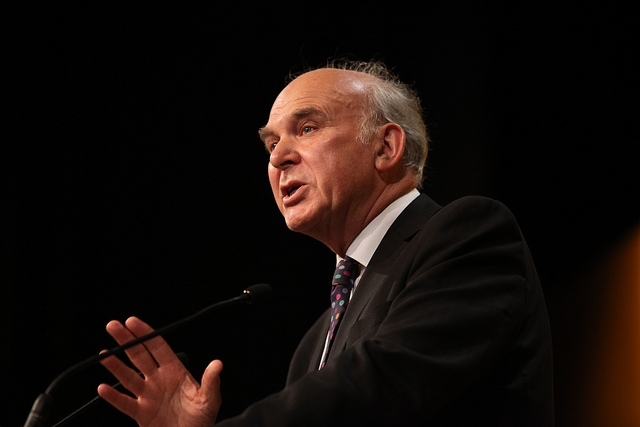

Late payments to SMEs must not be an acceptable way for big businesses to boost their own profits, according to business secretary Vince Cable, who is taking action to improve the transparency of corporate payment practices.

In a recent government consultation, the majority of respondents voted in favour of disclosure as a means of tackling late payments - and the government is now planning to require publication of payment practices by large companies.

The Prompt Payment Code will also be strengthened, with signatories held more accountable for their actions - although it is worth remembering that this is currently still a voluntary initiative.

Read more: Cable: Big businesses have profited 'for long enough' from late payment